Why I Built Pelican

The investing workflow behind Pelican: high-velocity idea generation, deep underwriting, and auditability via AI agents.

I built Pelican Alpha in 2025 after deciding to codify what was working in my own investing. I’ve been investing in public equities since 2018. Pelican exists to solve the single biggest bottleneck I faced as an investor: turning over enough stones to find real opportunities, then underwriting them before alpha decay sets in.

This series—Insights—is where I will publish stock notes, investing frameworks, and market observations derived from that process.

My Background

I started my investing career at the multi-family office ICONIQ Capital, moved to the activist hedge fund Osmium Partners, and later managed a concentrated long-only strategy.

Throughout my career, I’ve worked across activism, secular growth, long/short, and deep value strategies. However, my personal “sweet spot”—and where I’ve generated the most alpha—is in GARP (Growth at a Reasonable Price) and Special Situations.

I am a CFA charterholder with a background in economics and accounting from UCSB. I began my career in public accounting, which gave me the foundation I use today to analyze financial statements.

How I Think About Markets

I don’t believe markets are fully efficient. A simple proof of this is the massive variance between many stocks’ 52-week highs and lows.

As Joel Greenblatt has pointed out, businesses don’t fluctuate in value by 50% or 80% in a single year, yet their stock prices often do. If the market were a precise weighing machine, these swings wouldn’t exist.

My mental model is simple:

- Look at a massive number of ideas (High Velocity).

- Kill the bad ones quickly (High Filter).

- Concentrate capital when you find the obvious winners (High Conviction).

You don’t always need a complex, contrarian view on Apple or Nvidia. The less trafficked parts of the market—especially small caps—are naturally less efficient. If you are nimble and systematic, the opportunities are real.

Track Record

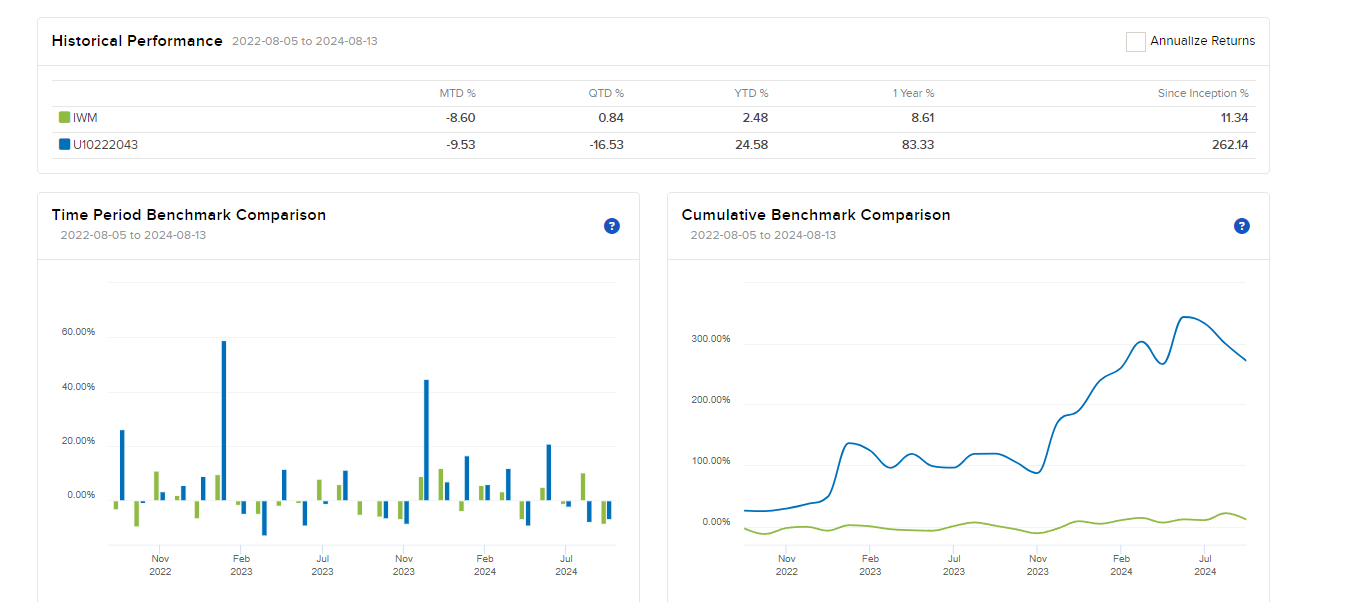

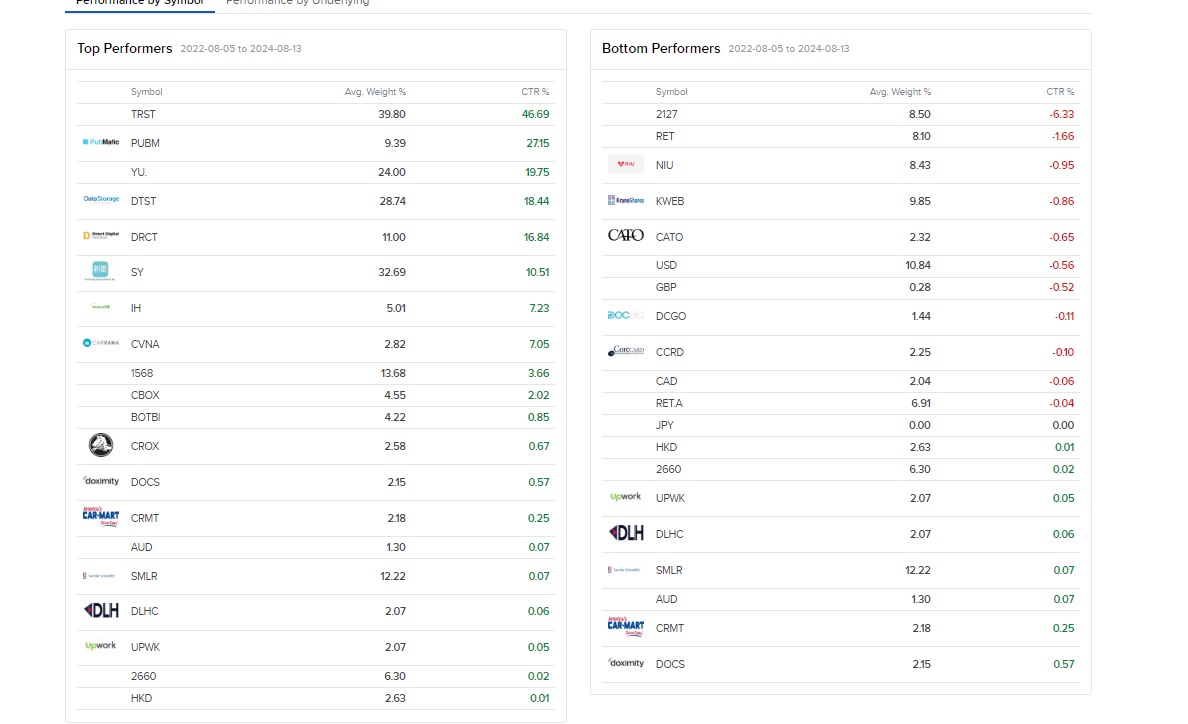

I used this exact “turn over stones + kill bad ideas” process to quadruple my capital from 2022 to 2024 while managing my previous strategy.

Today, utilizing the Pelican software, my personal account is up a little over ~60% YTD (as of December), while holding roughly 40% in cash.

Documentation of the two-year ~4x personal compounding period is available upon request. Past performance is not indicative of future results, and investing always involves risk.

The Framework Behind Pelican

My approach is a synthesis of the investors who were generous enough to share their work—Buffett’s focus on quality, Greenblatt’s special situations, and Druckenmiller’s concentration. Pelican is my attempt to translate their lessons into a repeatable software process:

1. Discover (Idea Generation)

Historically, I sourced ideas manually. Pelican systemizes this into a daily engine that surfaces ideas automatically based on 7 distinct signals, including insider buying clusters, 13F changes, proprietary quant screens, and others.

2. Underwrite (Deep Research)

Pelican reports emphasize valuation, but they go much deeper. The system categorizes every stock into one of 5 company archetypes (e.g., Turnaround, Compounder, Asset Play) and runs 30+ analyses tailored to that specific archetype, including industry dynamics, management incentives, governance, and shareholder alignment.

3. Interrogate (Debate & Audit)

We built AI agents that function like a dedicated research analyst. You don’t just read the report; you pressure-test it. You can debate the thesis, demand evidence, and pull citations directly from filings and transcripts to verify the data.

I’m a big believer in AI—not as a replacement for judgment, but as a force-multiplier that turns hours of grind into minutes so more time goes to first-order thinking.

Who This Is For

Pelican is designed for smaller funds and serious individual investors who want an institutional-grade workflow.

It shines in the small and micro-cap space, where the opportunity set is richest and large capital pools can’t participate. However, it is also a powerful tool for pressure-testing theses on large caps to ensure you aren’t missing a blind spot.

A Personal Note

On a personal level, I was born in Brazil, I am ethnically Korean, and I moved to the U.S. at age 7. I’m currently living in Orange County with my parents and our dog, Xuxa.

When I’m not studying businesses, I’m usually playing basketball, watching MMA, or with my family.

I hope you enjoy the research.

Ricardo Lee

Founder, Pelican Alpha

Contact

- LinkedIn: ricardo-lee-cfa-89a13812a

- Email: [ricardo.lee@pelicanalpha.com](mailto:ricardo.lee@pelicanalpha.com)